US President Joe Biden signed the big climate bill – the Inflation Reduction Act (IRA) – in August. It includes a wealth of rebates and tax credits to help Americans transition to electrification with the purchase of everything from electric vehicles to high-efficiency electrical appliances to heat pumps. If you’re ready to electrify but you’re not sure where to start, then check out this easy-to-understand IRA Savings calculator from Rewiring America.

Rewiring America is an electrification nonprofit whose “purpose is to make electrification simple, measurable, and inevitable.” I’m going through the electrification process now, so the Inflation Reduction Act calculator is my go-to. (We’re in the process of buying a US-made Volkswagen ID.4, and Rewiring America has been invaluable for finding the information I need to ensure I qualify for a tax credit.)

I’m finding in my electrification journey that I am responsible for advocating for myself, as electricians, heat pump installers, and even car dealerships aren’t quite sure yet about how tax credits and rebates work.

But I have found that they want to know, and they want to help me in turn, as everyone I’m working with wants to fight the climate crisis, so they’re grateful when I share the information I find with them.

IRA Savings Calculator – the “Smith family”

The IRA is still pretty new, so Rewiring America rightly disclaims:

We do not yet know how or when upfront discounts will be implemented in each state, so we cannot guarantee final amounts or timeline.

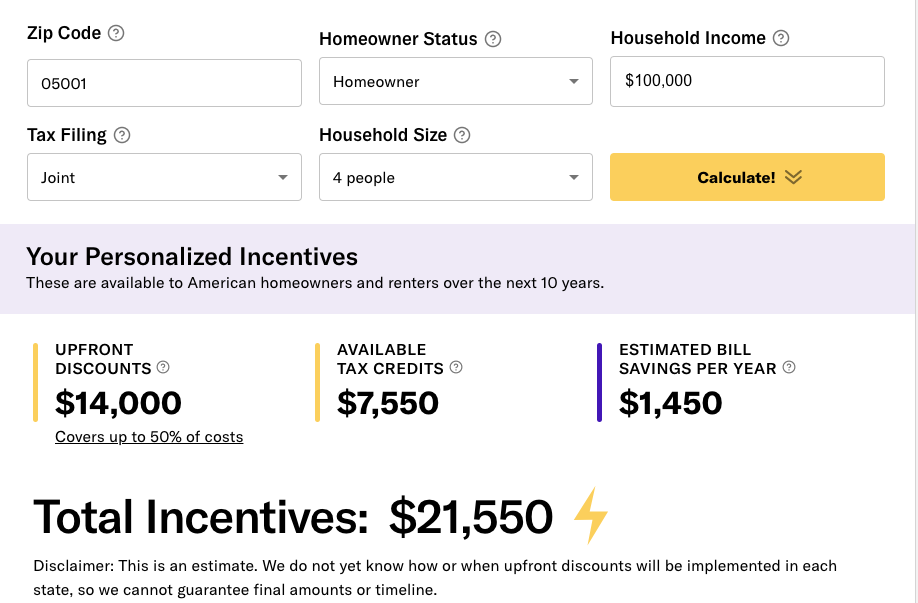

Here’s how the IRA Savings Calculator works: Type in your zip code, homeowner status (renters qualify too), your household income, tax filing status, and household size into the IRA Savings Calculator, and click “Calculate!” It then displays your personalized incentives and splits out tax credits from upfront discounts (i.e., rebates).

I created the “Smith family” as a case study: a hypothetical family of four, homeowner, household income $100,000, joint tax filing, zip code 05001 (that’s Vermont). The Smiths qualify for $14,000 in upfront discounts and $7,550 in available tax credits.

As upfront discounts (rebates) are based on a percentage of area median income, the Smith’s area median income is $90,100, as they live in the 05001 zip code area. Area median income can be found using this Area Median Income Lookup Tool from Fannie Mae.

Upfront discount on a new electric stove

The High-Efficiency Electric Home Rebate Act (HEEHRA) provides point-of-sale consumer rebates to enable low- and moderate-income US households to electrify their homes.

So if the Smith family wanted to replace their gas stove with a new electric stove, for example, then they would qualify for 50% of electric/induction stove costs up to $840, upfront, as their income ($100,000) is over 100% of area median income ($90,100) in their 05001 zip code:

For low-income households (under 80% of Area Median Income), HEEHRA covers 100% of your electric/induction stove costs up to $840. For moderate-income households (between 80% and 150% of Area Median Income), HEEHRA covers 50% of your electric/induction stove costs up to $840.

Total HEEHRA discounts across all qualified electrification projects are capped at $14,000.

Rewiring America also provides an easy-to-understand online guide to the IRA called “Go electric! (now).” You can access that here.

Read more: Here’s how the new US tax credits and rebates will work for clean energy home upgrades

UnderstandSolar is a free service that links you to top-rated solar installers in your region for personalized solar estimates. Tesla now offers price matching, so it’s important to shop for the best quotes. Click here to learn more and get your quotes. — *ad.

Read the full article here