Big global companies have secured a record 36.7 gigawatts (GW) of clean energy to power their operations in 2022, up 18% from 2021 – and big tech bought the most, according to a new report.

BloombergNEF’s (BNEF) “1H 2023 Corporate Energy Market Outlook” assessed 167 big corporations that announced power purchase agreements (PPAs) in 36 markets worldwide.

A PPA is a contract between an electricity generator and a power purchaser, such as a utility company and in this case, large commercial energy user.

In total, corporations have signed PPAs for 148 GW of clean power since 2008 – more than the total power-generating capacity of France.

In the US, companies have adopted the virtual PPA model, in which a clean power project sells directly into the wholesale market to capture the spot price, rather than literally delivering its electrons directly to the customer. Such contracts are comparatively easy for buyers to sign and allow them to hedge against power price spikes.

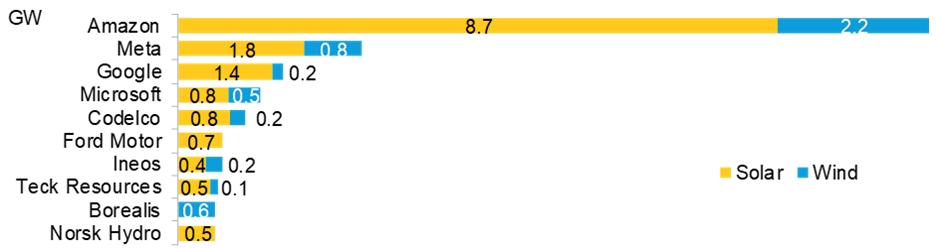

Big tech firms were the top corporate clean energy buyers in 2022. Amazon led with 10.9 GW of PPAs signed in 2022, followed by Meta (2.6 GW), Google (1.6 GW), and Microsoft (1.3 GW).

Amazon has announced 24.8 GW of PPAs to date, giving it the seventh-largest clean energy portfolio in the world – and that takes utilities into account. And tech companies will need to keep on buying clean energy to supply their rapidly growing electricity demand.

In 2022, 56 new companies joined the RE100 – which are companies that have committed to sourcing 100% of their electricity from renewable sources. In all, the 397 RE100 companies have purchased an estimated 249 terawatt hours (TWh) of clean electricity to date, but they’ll need an additional 290 TWh in 2030 to meet their goals, according to BNEF projections.

Companies like Google and Microsoft have pledged to meet their demand for power at all hours of the day with carbon-free energy, so demand will be even higher.

Kyle Harrison, head of sustainability research at BloombergNEF, said:

Corporate clean energy buying has been an unwavering constant even as other aspects of [environmental, social, and governance] investing have come under scrutiny.

Companies can access clean energy at scale in most major countries, the economics make sense, and amid turbulent energy markets, PPAs have become useful risk-mitigation tools for CFOs.

Read more: Renewables supplied nearly 75% of new US electrical generating capacity in 2022

UnderstandSolar is a free service that links you to top-rated solar installers in your region for personalized solar estimates. Tesla now offers price matching, so it’s important to shop for the best quotes. Click here to learn more and get your quotes. — *ad.

Read the full article here