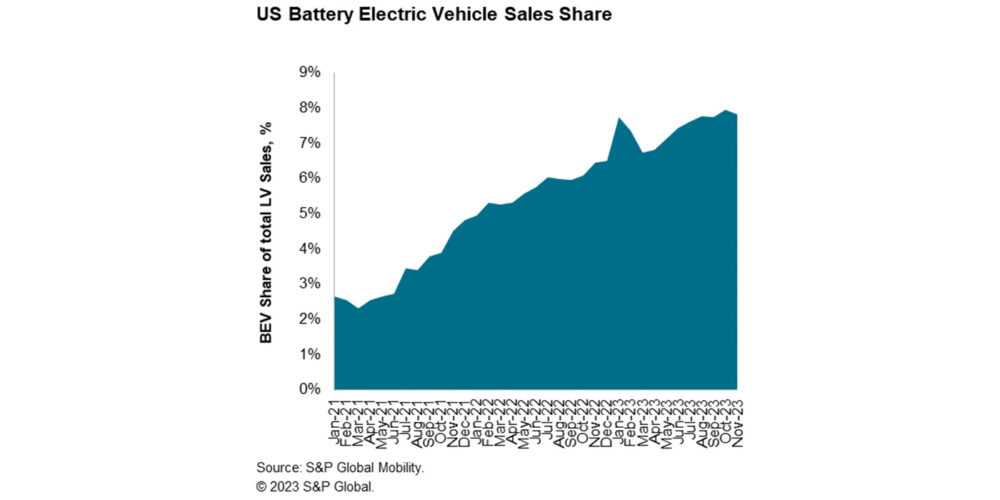

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer-term of S&P Global’s Mobility light vehicle sales forecast, S&P Global Mobility said. In the immediate term, some month-to-month volatility is anticipated. Data from October 2023 shows that BEV share was expected to reach 7.8%, similar to the month prior reading and pushing year-to-date BEV sales growth to an estimated 47%. BEV programs previously expected for stronger launches in Q4 2023 have been delayed to 2024, creating an opportunity for BEV to share advances beginning early next year.

Electric vehicle (EV) retail advertised inventories (not including Tesla) also peaked in mid-October at 135,000 units and have declined slightly since then. Most BEV nameplates have reached an inventory plateau and flattened off, S&P said.

On an unadjusted volume level, S&P said November US light vehicle sales were expected to advance mildly from the strike-impacted levels of October but remained absent of any momentum. S&P Global Mobility projected a sales volume of 1.23 million units for November, which translated to a seasonally adjusted sales rate (SAAR) of 15.5 million units for the month, even with the month-prior level.

New vehicle retail advertised inventory listings peaked in mid-October, just shy of 2.5 million units and have seen a slight decrease since then – from an end-of-October level of 2.35 million units to about 2.3 million in mid-November, S&P said.

Read the full article here