Lithium supply may soon exceed demand for use in EV batteries, potentially bringing price parity with internal-combustion vehicles later this decade, according to a new study from the International Council on Clean Transportation (ICCT).

New emissions rules proposed by the EPA are expected to boost EV sales to 67% of total U.S. new-car sales by 2032, but based on anticipated lithium mining and refining capacity, there should still be a large surplus by that year, the study found. And that’s with EPA’s current proposal. The Biden administration is reportedly seeking to allow weaker emissions standards that might change the trajectory, with even lower demand.

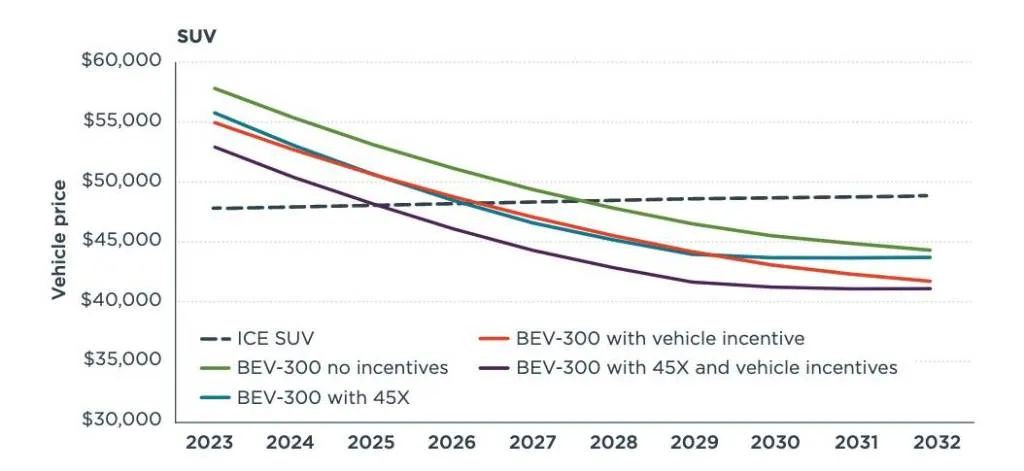

ICCT projected EV price scenarios through 2032

Battery raw-material prices are a major factor in the overall cost of EVs, but the ICCT expects “substantial” battery and vehicle cost reductions regardless of the raw-material situation over the remainder of the decade. That will help cut EVs on the path to price parity with internal-combustion cars, but exactly when that happens will depend on whether current Biden administration EV policies remain in place, the ICCT noted.

Analysts considered multiple scenarios, including different levels of EV incentives, that could affect the timing for price parity. Inflation Reduction Act (IRA) incentives for battery production and EV purchases could also move up the moment when EVs achieve price parity with internal-combustion cars by three years, the study found.

ICCT projected EV price scenarios through 2032

Price parity is also likely to be achieved earlier by SUVs, as the higher purchase prices of gasoline models leave less of a gap with their electric counterparts. Smaller battery packs are another factor that could change the cost equation and make rebuilding U.S. lithium production infrastructure easier—if they’re adopted by automakers.

This study reaches similar conclusions to a Bloomberg study released last year—suggesting that the drop in lithium prices could have a corresponding effect on EV prices. Between 2030 and 2035, many analysts and companies have said they expect EV costs to come down substantially versus internal-combustion models. Perhaps that shift will now happen a little bit earlier.

Read the full article here