Despite facing many challenges, the global automotive industry performed well in 2023, according to JATO Dynamics. JATO data and estimations showed that for 151 markets across the world, a total of 78.32 million new passenger cars were sold last year. This marks an increase of almost seven million units from 2022 — a 10% increase.

“The growth seen in 2023 is remarkable, especially considering the ongoing geopolitical tensions between China and the USA; the instability generated by conflicts across Europe; the high interest rates that persisted in most of the Western world; and the high price of vehicles,” Felipe Munoz, senior analyst at JATO Dynamics, said.

However, last year’s positive results were not driven by China. While the annual volume for this region increased by 6% when compared to 2022, both the USA-Canada and Japan-Korea saw an increase of 12%. In fact, Europe was the fastest-growing market in 2023 as a result of booming demand in Turkey, the region’s fourth-largest market, ahead of Spain. In addition to this, the strong push from the local authorities to incentivize demand for electric vehicles (EVs) also contributed to accelerated sales, JATO data found.

Every region, except Africa, saw demand for new cars increase. According to JATO Dynamics data, sales volume in this region decreased by 6% to 956,000 units. JATO said this result can be explained by a significant decline in Egypt, which was the continent’s second-largest market in 2022 and the third last year. South Africa accounted for 51% of the continent’s total, while North Africa represented 34%.

While the industry generally focuses its attention on the European, US, and Chinese automotive markets, 22% of new car sales in 2023 came from emerging economies. “Over 17.5 million new cars were sold in the emerging economies in 2023. That is more than the total sales in US or Europe during the year,” Munoz said.

India led this group by a significant margin — as the fourth-largest individual market in 2023, it sold 4.19 million passenger cars, JATO said. Brazil and Iran followed with 2.12 million units and an estimated 1.43 million units, respectively. 1.30 million units were sold in Mexico, while Turkey accounted for 984,000 units.

The market share of Chinese car brands grew across regions such as the Middle East, Eurasia, and Africa, while posting growth in Latin America and Southeast Asia. These cars also gained a share in developed economies, including Europe, Australia, New Zealand, and Israel. In contrast, the US and India saw little uptake of Chinese cars, similar to Korea and Japan.

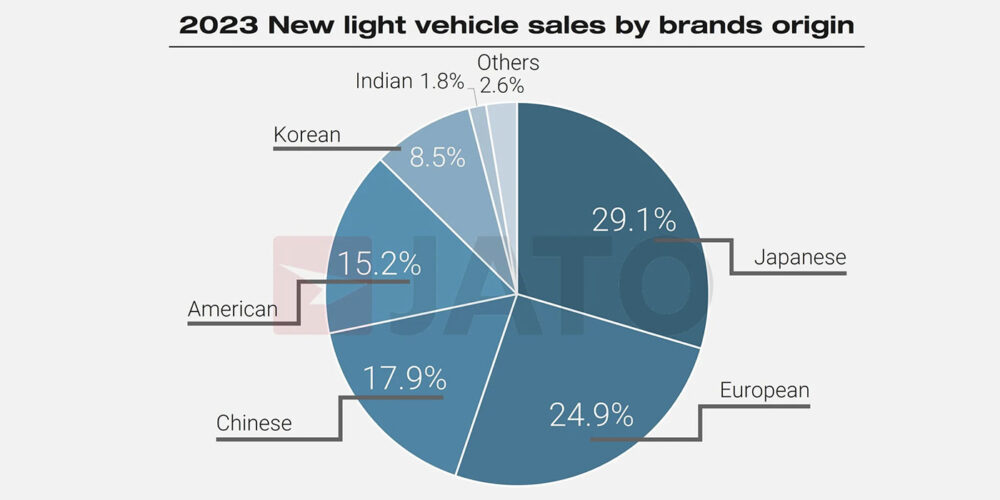

In 2023, Chinese brands outpaced their American rivals for the first time. Chinese-origin brands sold 13.43 million new cars in 2023, up by 23%, while their American brands sold 11.93 million units, up by 9% from 2022. Japanese brands maintained a strong position in the global market with a total of 23.59 million units.

“As the domestic market shows signs of deceleration, Chinese manufacturers are searching for sources of growth abroad,” Munoz said. “Ambitions to develop a presence in the US and Europe have been disrupted by robust policy measures designed to protect legacy manufacturers. Chinese brands have already been successful across emerging economies due to easier access policies, lower trade barriers, and higher price sensitivities among consumers. The EU decision to impose tariffs of up to 38% on imported Chinese EVs from as soon as July this year offers fresh rationale for a continuation of this strategy.”

With 36.72 million units sold last year, not only did SUVs post a new sales record but also recorded their highest-ever market share, according to JATO data. Between 2022 and 2023, SUV volumes increased by 16%, accounting for closer to 47% of the total global passenger car sales last year.

Growth was largely due to the success of Tesla in the SUV segment (+62%), alongside increased demand in Europe, India, the Middle East and Eurasia, JATO said. China and USA-Canada remained the largest markets for SUVs, accounting for 54% of the global total.

Among the top 10 largest car makers in 2023, Hyundai-Kia was most dependent on sales of SUVs, with these vehicles accounting for 56% of its passenger car sales, followed by Ford (49%), and Volkswagen Group (48%).

As anticipated in JATO’s preliminary 2023 results, released in February, the Tesla Model Y made history last year. The midsize SUV secured the top position in the global ranking as the first ever pure electric vehicle to lead the global market.

JATO data found that the Model Y secured this position without a presence in most emerging markets, where it continues to be unaffordable for the majority of consumers.

Sales of the Tesla Model Y totaled 1.22 million units globally, up by 64% from 2022, or 480,000 more units than 2021 — a result achieved by no other manufacturer before. Consequently, the Model Y managed to outsell traditional global top-sellers like Toyota’s RAV4 and Corolla sedan.

In previous years, these models have featured at the top of the ranking due to healthy demand in North America, China, the Middle East, Europe, Australia, New Zealand, and many markets across Latin America, Africa, and Central Asia.

The RAV4 sold 1.07 million units (+5%), while the Corolla sedan placed fourth with 803,000 units (-19%). Weakening sales of the compact sedan can be attributed to its age – the vehicle was first released in March 2018 – along with the arrival of the Corolla Cross, its SUV counterpart, which quickly gained popularity in developing economies. The Honda CR-V occupied the third position following an 18% increase in sales.

Toyota placed another two models in the top 10, while the Tesla Model 3 secured the 10th position. Other big players included the Ford F-150 and the Nissan Sentra.

The most popular Chinese model was BYD’s compact sedan, the Qin. This was placed in the world’s top 25 alongside two other BYD models. Among the top 25 were 13 Japanese models, five American, three Chinese, and two Korean and European models.

Read the full article here