According to JATO Dynamics’ data for 28 European markets, European new passenger car registrations totaled 1,087,699 units in May – a 2.5% decline compared with the same month last year. However, registrations remained higher than May 2022 and 2021, when total units amounted to 943,405 and 1,082,934, respectively.

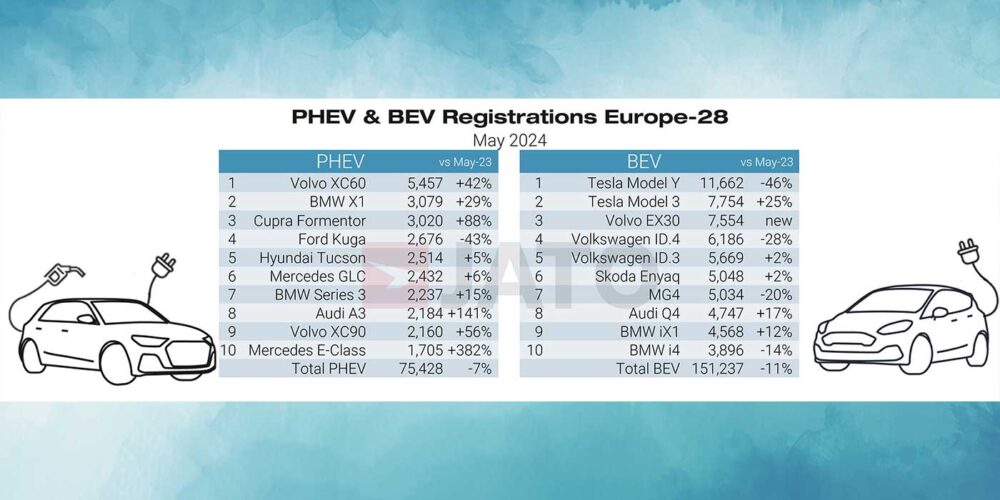

This reduction is partly explained by a 10% decline in the registrations of battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), JATO data found. Registrations of these vehicles dropped from 250,530 in May 2023, to 226,665 in May 2024. BEVs saw the largest decline in year-on-year registrations, falling 11% to 151,237 units, while PHEVs experienced a 7% decrease.

“Since the global pandemic, the European car market has only recovered to 75%-80% of its original size,” Felipe Munoz, global analyst at JATO Dynamics, said. “As a result, many factories across Europe are not operating at full capacity, giving Chinese OEMs a unique opportunity to sell across Europe while avoiding tariffs.”

“This negative result comes as a result of high BEV and PHEV prices – with these cars still unaffordable for the masses,” Munoz added.

Despite this, some BEV models continued to perform well last month. BMW continued to gain traction with its iX1, as well as the new i5 and iX2. The brand’s BEV volume was approximately 1.6 times higher than all-electric models registered by Audi or Mercedes. Volvo claimed third place amongst the top-selling BEVs both in May and year-to-date with the EX30, according to JATO data.

Last month, registrations of Chinese-made BEVs rose by 25% year-on-year to reach almost 28,000 units. In contrast, electric vehicles manufactured outside of China saw a 16% decline in registrations year-on-year.

“Last month, the market share of Chinese-made BEVs jumped from 13.2% to 18.5% year-on-year,” Munoz said. “It’s striking that two Chinese models secured a place in Europe’s top five best-selling BEVs for May. This increase in registrations likely comes in anticipation of the impending European Commission tariffs.”

Volvo, BYD, and Smart saw the most significant increases in BEV registrations, while MG, BMW, Dacia, and Polestar all lost ground, according to JATO data. MG’s ICE offering outperformed its BEVs, with volume increasing by 47% in May, and by 61% since the start of the year.

“MG is turning its attention to non-electric cars to maintain ground in Europe. This is likely a response to the European Commission’s probe and incoming tariffs,” Munoz said. “For instance, in January – May 2023, it registered almost an equal number of electric and combustion cars. A year on, its volume of ICE cars is nearly double that of its BEV registrations.”

The Volkswagen Golf registered 20,000 units in May, becoming the second most-registered car, behind the Volkswagen T-Roc. According to JATO data, the Golf’s volume increased by 30%, driven by higher fleet and business registrations, securing second place in the overall model ranking year-to-date.

Other notable models last month included the Citroen C3, supported by deals on its previous generation. The Cupra/Seat Leon, Toyota RAV4, Seat Ibiza, Opel/Vauxhall Astra, and Jeep Avenger also posted year-on-year growth.

Among new models, the Volvo EX30 performed well in May, with more than 7,500 units registered. JATO data found that other notable players included the Lexus LBX with over 2,100 units; the BMW i5 with almost 2,000 units; the new Renault Scenic with 1,631 units; and the Mercedes CLE with 1,581 units. Fiat registered 1,515 units of the 600; Volkswagen registered 1,239 units of the ID.7; BMW registered 1,144 units of the iX2; the Mitsubishi Colt registered 1,058 units; and the Renault Rafale and Omoda 5 registered 1,003 and 797 respectively.

Read the full article here