According to recent JATO Dynamics’ data for 28 European markets, demand for BEVs rebounded in Europe in September as buyers reacted positively to incentives, despite ongoing concerns about the future of electric cars on the continent. A total of 212,197 new BEVs were registered last month – up 14% from September 2023. Despite the monthly uptick in registrations, year-to-date volumes fell by 3% compared to the corresponding period in 2023, with 1.43 million units registered so far in 2024.

“It’s hard to say for certain whether BEVs will continue along this positive trajectory, but the monthly increase in registrations is welcome news – especially considering that consumers still have reservations about the adoption of electric cars,” Felipe Munoz, global analyst at JATO Dynamics, said.

JATO’s data revealed that 1,119,320 new cars were registered in September. This is around 40,000 less than the amount registered in September 2023, or a 3% year-on-year drop.

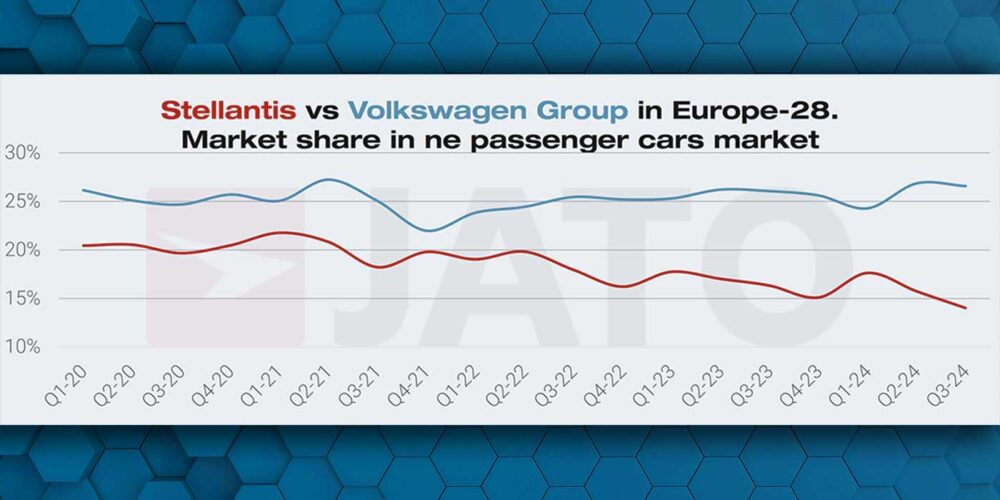

Stellantis was largely responsible for the volume decrease in the overall market in September, posting a 25% decline in registrations compared to September 2023 – a drop of almost 50,000 units, according to JATO data. The company recorded a significant fall in sales in 22 of the 28 European markets, most notably in Italy (-34%) and France (-17%), its two main markets. Stellantis brands that experienced a steep decline in sales last month include Fiat (-43%), Citroen (-41%) and Opel/Vauxhall (-24%).

“Stellantis may see these results as an indicator that the time has come to refresh its offering and reposition its BEV lineup to ensure the downward trend doesn’t continue,” Munoz added.

Within the BEV segment, JATO data found that the Volkswagen Group performed well (22.8% market share in September 2024 vs.19.8% in September 2023), as well as Tesla (20.9%, up from 18.2%), BMW Group (9.6%, up from 8.1%) and Geely Group (7.6%, up from 5.0%). In contrast, Stellantis’ market share dropped to 10.6% in September compared to 14.8% in the corresponding month last year. Other makers that recorded a year-on-year decline in monthly market share include Mercedes (down from 8.1% to 6.3%), Hyundai-Kia (down from 7.5% to 6.0%), Renault Group (down from 5.5% to 3.7%) and SAIC (down from 6.3% to 3.2%).

Despite registrations of the Tesla Model Y falling by 1% last month compared to September 2023, the model led both the BEV and overall ranking last month, JATO said. Registrations of Tesla models rose by 31% last month, driven by the updated Model 3 – the second best-selling BEV last month. The Volkswagen ID.7 also performed well with close to 5,500 registrations. Other key players last month included the new Citroen e-C3 (over 3,600 units), as well as the Volvo EX30, the Ford Explorer EV, the Renault Scenic, the Mini Cooper and the Peugeot e-3008, JATO said.

Volkswagen Group recorded a 2% increase in volumes last month compared to the same month last year, according to JATO data. This can largely be attributed to Skoda – Europe’s third best-selling car brand in September. Other strong performances included Toyota (+4%), BMW Group (+6%) and Geely Group (+25%).

The Dacia Sandero, Europe’s best-selling car to date, was the third best-selling vehicle of the month in the overall ranking after the Tesla Model Y and Renault Clio. The Volkswagen Tiguan occupied fourth spot, largely boosted by the latest generation of the model, while the Toyota C-HR, BMW X1, Skoda Enyaq and Karoq were all popular models in September.

Read the full article here