The big climate, energy efficiency, and EV bill – the Inflation Reduction Act (IRA) – became law in August. It’s packed with loads of rebates and tax credits that will help Americans purchase everything from electric vehicles to high-efficiency electrical appliances to heat pumps. If you’re ready to electrify but you’re not sure which rebates and tax credits you qualify for, then check out this easy-to-use IRA savings calculator from Rewiring America.

Rewiring America is an electrification nonprofit whose “purpose is to make electrification simple, measurable, and inevitable.” I’m going through this process now myself, so this savings calculator is my go-to.

We recently bought a US-manufactured 2023 Volkswagen ID.4, and the Rewiring America calculator helped confirm the amount of tax credit the car qualified for – fortunately, the full $7,500 tax credit.

In my electrification journey, I’m finding that I need to do my own research and advocate for myself, as electricians, heat pump installers, and car dealerships are still learning about how the new tax credits and rebates work. (Then I share what I learn with all of you – that is my job, after all.)

The folks I’m working with want to know, and they want to help me in turn. Everyone I’m working with is concerned about climate change, and they appreciate it when I share the information I find with them.

Inflation Reduction Act savings calculator – the “Smith family”

The IRA is still fairly new, so Rewiring America rightly disclaims in the FAQs section:

Unfortunately we don’t know exactly when the electrification rebates marked “2023” will be available, because it will depend on how each state rolls out its incentive program. Our best guess is that electrification rebates will be available in late 2023.

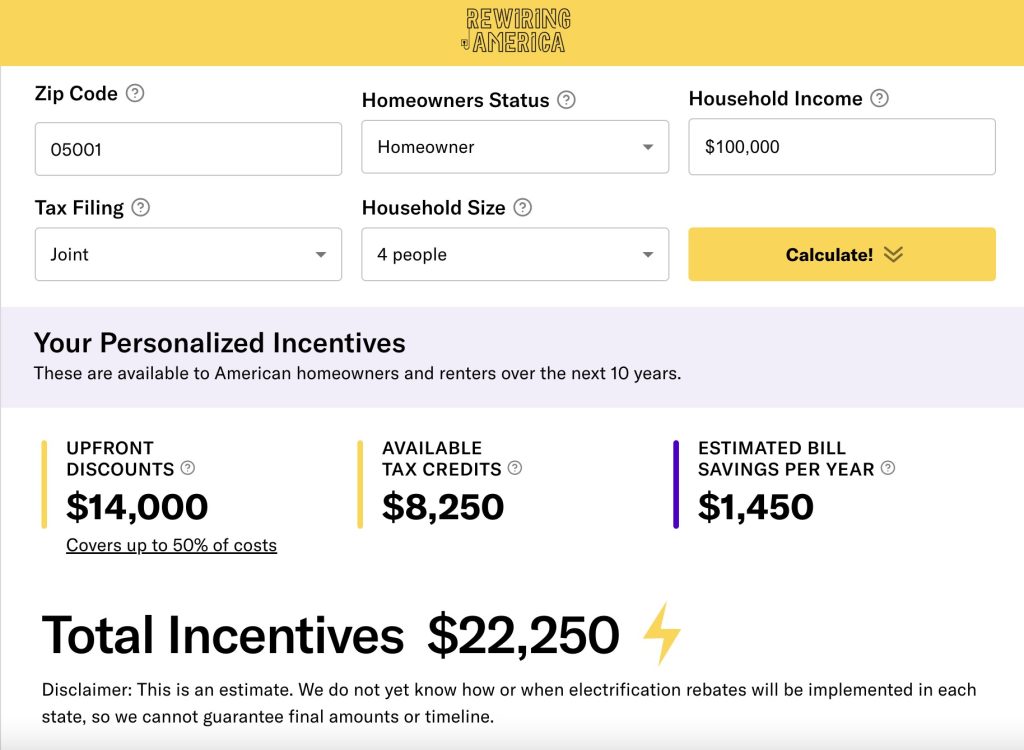

Here’s how the IRA Savings Calculator works: Type in your zip code, homeowner status (renters qualify, too), household income, tax filing status, and household size into the IRA Savings Calculator, and click “Calculate!”

It then displays your personalized incentives and splits out tax credits from upfront discounts (i.e., rebates).

I created the “Smith family” as a case study: a hypothetical family of four, homeowner, household income $100,000, joint tax filing, zip code 05001 (that’s Vermont).

The Smiths qualify for $14,000 in upfront discounts – that’s rebates – and $8,250 in available tax credits, with an estimated bill savings per year of $1,450, and the latter is based on energy costs in Vermont.

As upfront discounts (rebates) are based on a percentage of area median income, the Smith’s area median income is $90,100, as they live in the 05001 zip code area. You can find your area median income using this Area Median Income Lookup Tool from Fannie Mae.

Case study: Upfront discount on an electric stove

The High-Efficiency Electric Home Rebate Act (HEEHR) provides point-of-sale consumer rebates to help low- and moderate-income US households to electrify their homes.

So if the Smith family wanted to replace their gas stove with a new electric or induction stove, then they would qualify for 50% of electric/induction stove costs, up to $840, upfront, as their income ($100,000) is over 100% of area median income ($90,100) in their 05001 zip code:

For low-income households (under 80% of Area Median Income), Electrification Rebates (HEEHR) cover 100% of your electric/induction stove costs up to $840. For moderate-income households (between 80% and 150% of Area Median Income), HEEHR covers 50% of your electric/induction stove costs up to $840.

Total HEEHRA discounts across all qualified electrification projects are capped at $14,000.

Rewiring America also provides an easy-to-understand online guide to the IRA called “Go electric! (now).” You can access that here.

Read more: Here’s how the new US tax credits and rebates will work for clean energy home upgrades

UnderstandSolar is a free service that links you to top-rated solar installers in your region for personalized solar estimates. Tesla now offers price matching, so it’s important to shop for the best quotes. Click here to learn more and get your quotes. — *ad.

Read the full article here