- AAA survey finds Americans’ desire to buy an electric car is the lowest it’s been since 2019.

- Buyers are increasingly choosing non-plug-in hybrids as a happy medium of automotive electrification with the fewest downsides.

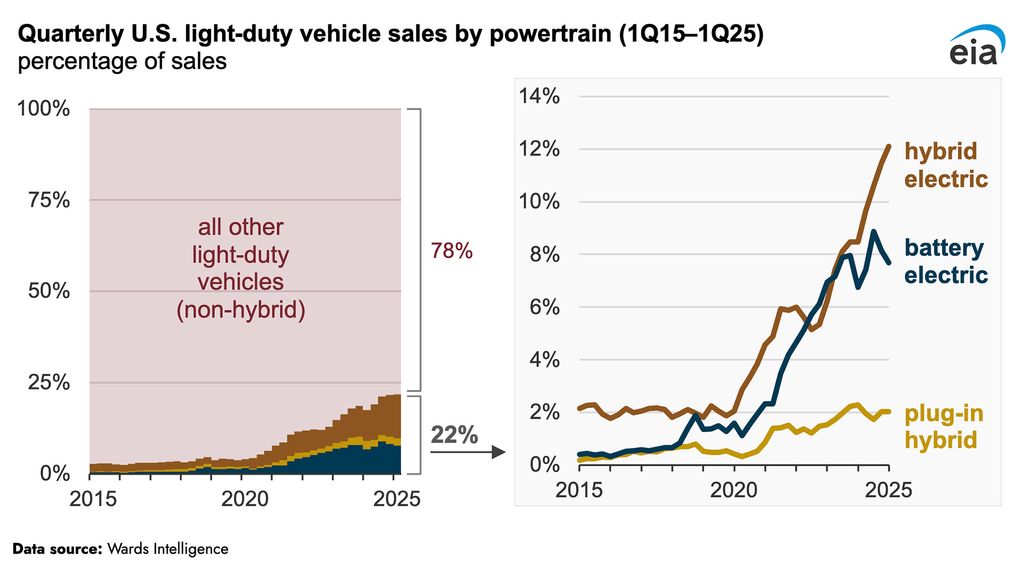

- Sales data from Q1 2025 supports this trend and shows a surge in hybrid popularity over EVs and PHEVs.

For years, there was a clear upward trend in Americans’ preference for pure electric vehicles. Although EV sales are lower than in Europe, the curve was generally positive with more and more U.S. car buyers considering switching away from gas.

However, a survey found that a much wider proportion of respondents would not get an EV, and the today, proportion is lower compared to findings from the 2023 edition of the same study.

AAA asked 1,128 Americans aged 18 and over if they wanted an EV as their next vehicle, and only 16% said they would “likely” or “very likely” consider the electric option. The number is down from just two years ago, when the same AAA survey found that 25% of the respondent pool, and by extension the entire American car-buying public, was seriously taking an EV into consideration.

Photo by: AAA

This number is the lowest the AAA has recorded since 2019, and it points to a strong change in buying trends. But what’s changed? Is the Trump administration’s war on EVs already having an effect? Or is charging just not where it needs to be yet?

It’s probably a combination of still high sticker prices and a lack of affordable models, plus charging and range anxiety (especially in winter) and the shift in the public narrative surrounding EVs spurred by the government’s new anti-EV views.

Recent budget proposals are threatening to roll back support for EVs on a federal level by cutting funding for charging infrastructure expansion and improvements. This, while China is encouraging and subsidizing the purchase of EVs and helping charging networks expand at a rate far greater than in the U.S. or Europe. Not only is China already ahead when it comes to charging coverage, but the power of its chargers is already far beyond what we have in the West, with plans to go even bigger.

Many buyers, especially those who want to keep a car for a long time, are also afraid of the very high potential cost of having to replace the battery in their EV, which can go into the tens of thousands of dollars. The cost is expected to come down significantly in the next few years.

AAA found that the percentage of buyers who would not consider an EV rose from 51% in 2019 to 63% this year, noting that it’s the highest since 2022. The main reasons why respondents wouldn’t get an EV were high battery repair costs (62%), purchase price (59%) and the lack of convenient public charging (56%). Running out of juice while driving was also an issue for 55% of those questioned.

Only 12% said the potential elimination of the federal tax credit and other EV incentives was a reason for them not to get an EV.

The same study reveals that an increasing number of Americans are turning to hybrids, the middle child of automotive electrification, which was supposed to be a stepping stone to full electrification. This trend is reflected in the recent sales data published by the U.S. Energy Information Administration, which also points to rising hybrid sales while EVs and plug-in hybrids are stagnating.

EV sales got off to a good start this year, growing 11.4% year-over-year. EIA data shows that around 22% of all light-duty vehicles sold were hybrids or EVs, compared to 18% in Q1 2024. It also notes that the increase is largely thanks to the popularity of hybrids, which have considerably outpaced plug-ins.

Photo by: US Energy Information Administration

The slowing EV sales could partly be attributed to fewer people picking former favorites, like the Tesla Model Y, Honda Prologue and Chevy Equinox, which weren’t sufficiently offset by increased sales of alternative models, like the Volkswagen ID.4 and Toyota bZ4X. The latter is now known as the Toyota bZ after a recent overhaul that has significantly improved it compared to the original.

Automakers are also putting more eggs in the hybrid basket. Toyota wants to sell 50% electrified vehicles in the U.S. in 2025, but it’s banking just as much on hybrids like the new RAV4 as it is on pure EVs. Toyota’s hybrids are apparently in such high demand that some buyers are having to wait nine months to take delivery.

General Motors, one of America’s top-selling EV manufacturers in 2024 and 2025, is bracing for the combined impact of import tariffs and anti-EV policies, and it’s readjusting its course from going fully electric as soon as possible to also launching some hybrids and plug-in hybrids to meet market demand. It will launch its first new plug-in hybrid in America in 2027, and it’s also likely working on non-plug-in HEVs, too, since this is what the market seems to be into right now.

Read the full article here