Congressional lawmakers are seeking to delay requirements for domestically sourced content under the revamped federal EV tax credit.

Bills recently introduced in the Senate and House of Representatives would create a more gradual phase-in for these requirements than is laid out in the new EV tax credit rules enacted under the Inflation Reduction Act (IRA).

The Senate version was introduced by Georgia Democratic Senator Raphael Warnock (who now faces a runoff election against Republican challenger Herschel Walker), with the companion House bill introduced earlier this month by Representatives Terri Sewell of Alabama, Emanuel Cleaver of Missouri, and Eric Swalwell—all Democrats who won their respective midterm races.

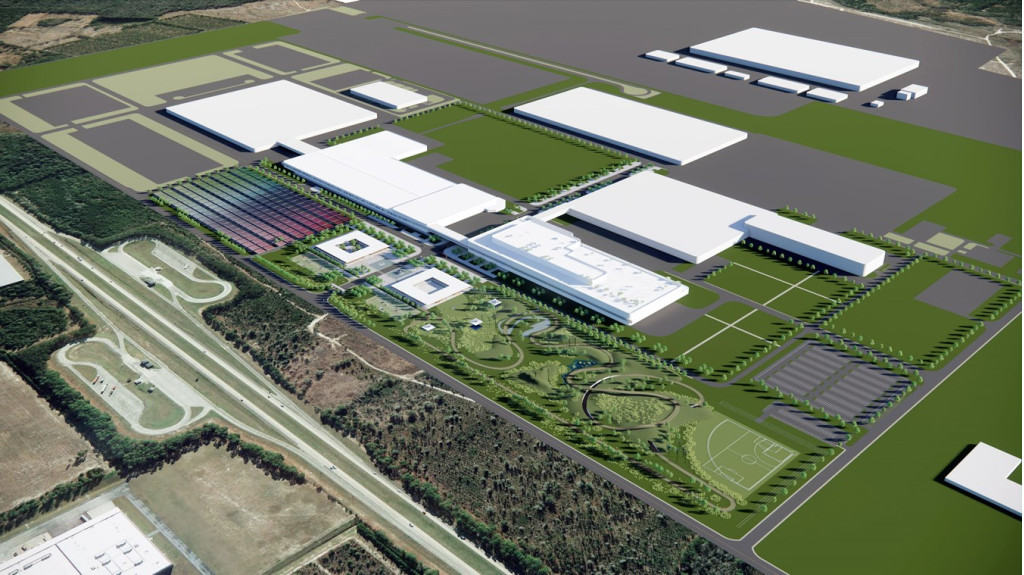

Mercedes-Benz battery factory

Under the IRA, the tax credit remains unchanged at $7,500. But to qualify for the full amount, EVs and their battery packs will have to be assembled in North America, and certain minerals used in batteries will have to be sourced either domestically or from countries with whom the United States has a free trade agreement.

Specific rules for the battery-mineral component weren’t included in the IRA, leading to some confusion about which EVs would actually qualify, but the Internal Revenue Service (IRS) and U.S. Treasury Department said in October that these rules will get fast-tracked, with guidance for automakers expected to appear before the end of the year.

But this new legislation could see implementation of those rules delayed. It would only require EVs sold after December 31, 2025, to be assembled in North America, with delays for the mineral and domestic battery manufacturing requirements as well.

Kia EV manufacturing in Georgia

The IRA reportedly gave Hyundai encouragement to fast-track its own U.S. EV manufacturing at its factory in Warnock’s state of Georgia. Hyundai has since confirmed it will build Kia EVs at the plant and said that it might expand the plant for 500,000 EVs annually.

General Motors, which is already manufacturing some EVs in the U.S. but likely won’t meet battery-sourcing requirements, recently noted that it still expects to qualify for the $3,750 at the start of the year, plus the full $7,500 amount in 2-3 years.

This extension appears to ask for no change on the price and income caps, so the tax credit would still be more limited than previously—and will add urgency to the arrival of affordable EVs.

Read the full article here