A few days ago, unless you lived in China or followed the auto industry as a professional or an enthusiast, you probably didn’t know anything about BYD. But now the Chinese giant just dethroned Tesla as the world’s top seller of electric vehicles in the final quarter of 2023, and that’s put it on everyone’s collective radar screens like never before.

That leads off this midweek edition of our Critical Materials news roundup. Also on tap today: we hear Vietnamese automaker VinFast’s plans for CES and look at Hyundai and Kia’s sales projections for 2024. Let’s hit it.

30%: And The Papers Want To Know Whose Shirt You Wear

In case you missed yesterday’s news, BYD outsold Tesla on the EV front in the last quarter, moving 526,409 electric cars to Tesla’s 484,507. For years, BYD has outsold Tesla in total cars, but those numbers have always included its plug-in hybrids too—now we’re just talking about purely electric vehicles.

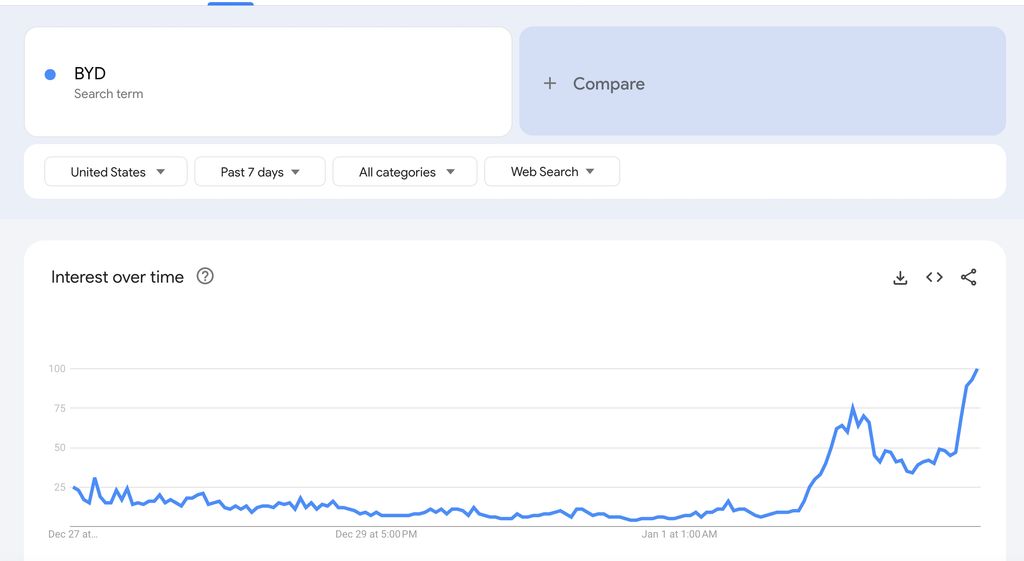

I’ve been wondering when the rest of the world would take notice of BYD, and it seems that moment has come to pass. Besides the glut of wider news coverage, let me point you to how Google searches for the brand are going:

Yes, it’s quite a moment for this car company. But how important is this news, really? If you look at this analysis from Reuters, it’s not that huge a deal. BYD’s sales success still mostly happened in China, and while that’s a crucial market for Tesla and other automakers, they aren’t having to do battle with BYD globally yet:

From an industry perspective, though, who’s on top is largely irrelevant for now.

BYD, after all, is benefitting from a home advantage, with China now the world’s largest market for new cars and boasting higher levels of EV penetration too. Granted, Tesla’s Shanghai factory is its biggest, able to produce around one million vehicles a year. But the country is also the American company’s main export hub, whereas its rival makes and sells around 90% of its vehicles in the People’s Republic.

Tesla, at present, has more geopolitical tailwind on its side. Its vehicles are sometimes barred from entering sensitive areas in China, but Musk has cultivated a good relationship with Beijing despite growing U.S.-China tensions. BYD and other Chinese automakers, meanwhile, are unlikely to make big inroads into the United States and could be hampered from exporting cars to Europe if the region’s authorities impose tariffs. The Chinese brand is also unlikely to get far in India, another big potential growth market that Tesla is eyeing, given border tensions between the two countries.

That story says that a bigger risk to the rest of the industry is one of perception: the belief, rooted in reality or otherwise, that the battery tech coming out of China is superior to what’s being made elsewhere. “That’s a much more important race to win,” the story says.

Interestingly, Bloomberg took a different tack and focused on the longer-term picture. We know BYD wants to aggressively expand into other markets—it’s building a factory in Hungary to make EVs for Europe and is all but certain to do the same in Mexico to target the U.S. market, which would in theory let it bypass America’s stiff tariffs on Chinese cars. From that story:

BYD is already setting its horizons well beyond China, with one in 10 of its cars sold overseas during December, compared to one in 40 in July 2022. The EV maker announced a new assembly factory last month in Hungary, and others are reportedly under consideration in Mexico. Such investments would mirror Japanese and South Korean carmakers, who got around protectionist tariffs since the 1980s by building production lines in key destination markets.

If its current trajectory is anything to go by, BYD’s relatively little-known status outside China is about to change drastically. In years to come, we’ll look back on 2024 as the year it joined the ranks of Tesla, Hyundai Motor Co., Toyota, Volkswagen and Ford as formerly obscure car brands that went on to bestride the world.

But the most notable detail is what the news wire calls BYD’s “industry-beating financial performance.” China’s automakers have become experts at getting EV costs down, including with manufacturing techniques the rest of the industry is trying to catch up to, and that’s translating into exceptional profits and returns for shareholders:

In contrast to Tesla, which racked up years of losses before turning profitable in 2019, it has hardly ever posted negative operating income — and in the September quarter came within a whisker of the reinvigorated US company’s $1.76 billion result. By owning its own battery supply-chain and focusing on cheaper, less zippy cells that use abundant iron and phosphate instead of scarce cobalt and nickel, it’s managed to lift margins even as materials costs rose.

There is, of course, a risk that BYD has grown too fast. But for now, this could be the year when we really see the results of what China’s automakers have been planning for some time.

60%: VinFast Plans Two Debuts At CES, But Things Remain Weird Behind The Scenes

Another automaker fighting to be taken seriously (and already selling cars in the U.S., it should be noted) is Vietnam’s VinFast. It’s planning two new car debuts at CES in Las Vegas next week, just opened a dealership with North Carolina’s Leith Automotive Group and says it’s building a $4 billion EV assembly plant near Raleigh.

But reputationally, VinFast has a lot to overcome, and that’s downplaying things. There were the intensely negative early reviews, the bizarre experience our own Kevin Williams had when he visited their headquarters in Vietnam and more accusations of financial impropriety. Here’s Wards Auto with a nice summary:

VinFast was founded in 2017 and is backed by Vietnam’s largest conglomerate Vingroup, which is run by Vietnam’s richest industrialist, Pham Nhat Vuong. The automaker began delivering electric cars in California in March and made its Nasdaq debut in late August. Vuong owns 99% of the shares. The stock soared to a 52-week high of $93.00 after its initial public offering but then crashed amidst speculation around share-price manipulation. VinFast shares closed at $8.48 on Dec. 27.

Where Vuong’s wealth and the company’s actual liquidity begins and ends appears murky. Vuong, for example, just “donated” a battery company, VinES, to VinFast Auto.

The company’s sales are sketchy, too. It sold about 13,000 units globally in the second and third quarter of 2023, more than half of them to an affiliate company owned by its founder.

We’re not holding our breath on this one, to put it politely. But we will be at CES next week and may look into the cars ourselves there.

90%: Hyundai, Kia Project Moderate Sales Increases In 2024

If you read our analysis of upcoming EV trends in 2024 yesterday, you know we’re keeping a close eye on Hyundai Motor Group in the electric race. You also know that for various reasons—interest rates, 2023 being a record new-car sales year, buyers holding out until more cars switch to Tesla’s NACS plug—this year may be a “wait and see” one rather than a major growth year.

We turn again to Reuters, which says the Korean automaker is projecting a 2% global sales increase in 2024, despite falling slightly short of targets in 2023:

The duo sold 7.3 million vehicles in 2023, about 3% less than their combined target of 7.52 million, largely due to a difficult economic environment, including rising interest rates and inflation that pushed vehicles out of the reach of some buyers.

Hyundai is aiming for a 0.6% rise in annual global sales to 4.24 million vehicles, while Kia set its sales target at 3.2 million units, up about 4% from last year.

“It seems that Hyundai’s goal appears to be more conservative than Kia’s … Kia is set to launch new electric vehicles this year, but we need to factor in how the recent slowing growth of global EV sales would fold out,” said Shin Yoon-chul, an analyst at Kiwoom Securities.

“Long-term sustainable growth” is what Hyundai Motor Group Executive Chair Euisun Chung told his employees when the new year started. It does seem that many automakers are now coming around to the value of playing the long game here.

100%: What Happens If BYD Starts Selling EVs In America?

Speaking of games, let’s play one. Pretend it’s 2025 (which is definitely on the early side, if we’re being honest) and BYD has just launched a lineup of Mexican-built EVs in the U.S. What happens next?

Read the full article here