New light vehicle registrations in California during the first nine months of 2023 amounted to 1,354,302, which is 14.3 percent more than a year ago. The market continues its slight rebound from a relatively weak 2022.

According to the California New Car Dealers Association’s (CNCDA) data and estimates, the growth of plug-in electric car sales significantly outpaced the general market.

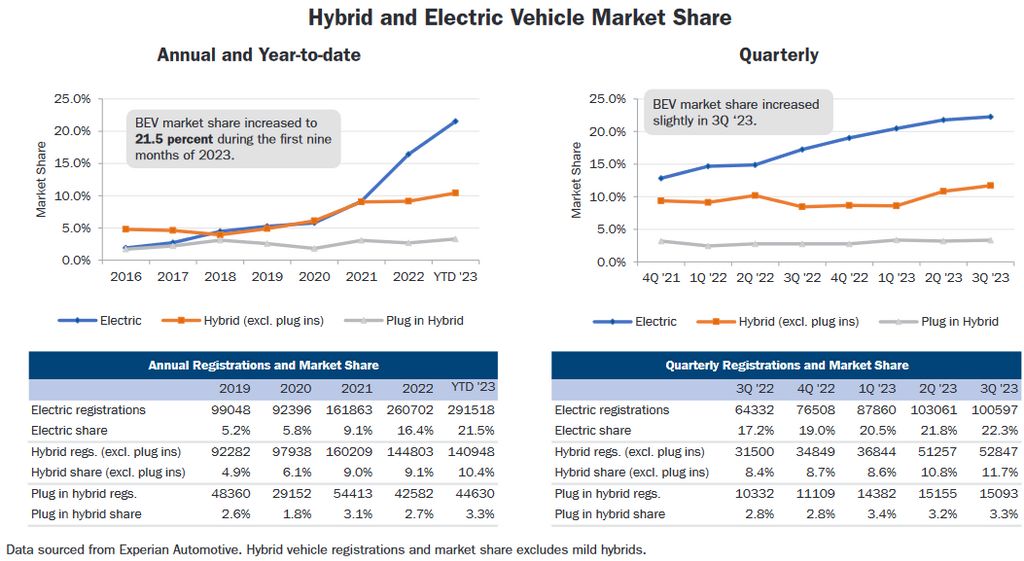

During the third quarter of 2023, some 115,690 new plug-in cars were registered in California, which is 55 percent more than a year ago and more than a quarter of the total market (25.8 percent share).

Battery-electric vehicle (BEV) registrations amounted to 100,597 (up 56 percent year-over-year), taking more than one-fifth of the market (22.4 percent). Plug-in hybrid vehicle (PHEV) registrations were also up (by 46 percent), to 15,093 (3.4 percent share).

Interestingly, the non-rechargeable hybrids also outpaced the general market and even plug-in cars, because the year-over-year growth amounted to 68 percent (52,847 units). However, non-rechargeable hybrids are already far behind all-electric cars in terms of volume.

Below, we attached the latest numbers for the quarter and year-to-date, with new graphs based on the latest data provided by CNCDA, which appear to be revised compared to the previous quarters.

Plug-in electric car registrations in California (est.) in Q3’2023 (YOY change):

- BEVs: 100,597 (up 56%) and 22.4% share

- PHEVs: 15,093 (up 46%) and 3.4% share

- Total plug-ins: 115,690 (up 55%) and 25.8% share

- HEVs: 52,847 (up 68%) and 11.8% share

- Total xEVs: 168,537 (up 59%) and 37.6% share

* some numbers were revised by CNCDA; some numbers estimated

So far this year, more than 477,000 new electrified vehicles were registered in California (35 percent of the total volume), including more than 336,000 rechargeable ones (25 percent of the total volume):

Plug-in electric car registrations in California (est.) in Q1-Q3’2023 (YOY change):

- BEVs: 291,518 (up 58%) and 21.5% share

- PHEVs: 44,630 (up 42%) and 3.3% share

- Total plug-ins: 336,148 (up 56%) and 24.8% share

- HEVs: 140,948 (up 28%) and 10.4% share

- Total xEVs: 477,096 (up 47%) and 35.2% share

For reference, the U.S. average BEV market share is estimated at 7.4 percent, the report says.

The Q3 was a near-record quarter in terms of volume and share, marginally behind Q2.

The number of stand-alone all-electric models – listed among the most registered ones in their subcategories – remains the same as in Q2.

Two Tesla cars – Model Y and Model 3 – are the best-selling ones overall in California. An interesting thing is that Rivian R1S jumped to the top of its category (Luxury Large SUV) with 3,832 units, noticeably ahead of the Mercedes-Benz EQS SUV.

All-electric car registrations (Jan-Sep 2023):

- Tesla Model Y (106,398): #1 in Luxury Compact SUV (66.8% share)

- Tesla Model 3 (66,698): #1 in Near Luxury Cars (53.2% share)

- Chevrolet Bolt EV/Bolt EUV (15,151): #4 in Small Cars (10.7% share)

- Ford Mustang Mach-E (7,972): #2 in 2 Row Mid-Size SUV (14.1% share)

- BMW i4 (7,107): #2 in Near Luxury Cars (5.7% share)

- Tesla Model X (7,032): #4 in Luxury Mid-Size SUV (9.8% share)

- Rivian R1S (3,832): #1 in Luxury Large SUV (16.9% share)

- Tesla Model S (3,150): #2 in Luxury and High-End Sports Cars (9.1% share)

- Mercedes-Benz EQS SUV (2,939): #3 in Luxury Large SUV (12.9% share)

- Mercedes-Benz EQS Sedan (2,688): #4 in Luxury and High-End Sports Cars (7.7% share)

- Audi Q4 e-tron (2,082): #5 in Luxury Subcompact SUV (12.1% share)

It’s worth noting that the Volkswagen ID.4 is not listed (outside of the top five in its category), but it’s one of the most popular BEVs, with 10,175 units sold this year through September. The Hyundai Ioniq 5 is also missing (7,209 units).

* red underline only for models that can be identified as plug-ins by their name

The top plug-in hybrids are Jeeps (13,301 units), although they are counted together with non-rechargeable versions.

Just like in the previous quarters, two all-electric cars – Tesla Model Y and Tesla Model 3 – happen to be the most popular new cars in California, with a pretty big advantage over the rest.

The top five models overall (Jan-Sep 2023):

- Tesla Model Y – 106,398

- Tesla Model 3 – 66,698

- Toyota RAV4 – 40,622

- Toyota Camry – 39,293

- Ford F-Series – 32,090

In Q3, Tesla noted more than 60,000 new registrations, although this time it was not enough to beat Toyota (70,314), which happened in Q2. Actually, the data indicates that Tesla’s share decreased compared to Q2 and amounted to just over 13 percent (which is still a high value, second only to Toyota).

Tesla also remains the dominant player in the BEV segment with about a 60 percent share. All non-Tesla BEV registrations combined were at about 40,536.

BEV registration results in California:

- Tesla Q3: 60,061 (up 43.0%, 13.3% share)

non-Tesla BEVs total: 40,536 - Tesla Jan-Sep: 183,278 (up 38.5%, 13.5% share)

non-Tesla BEVs total: 108,240

CNCDA shows that Tesla has a 4.3% share in the U.S. market in Q1-Q3’2023 period. Compared to 11,345,445 units, it would have to be almost 490,000 units.

The number of Teslas registered in states outside of California (calculated as the difference between the estimated total US and California) is roughly 305,000.

Read the full article here