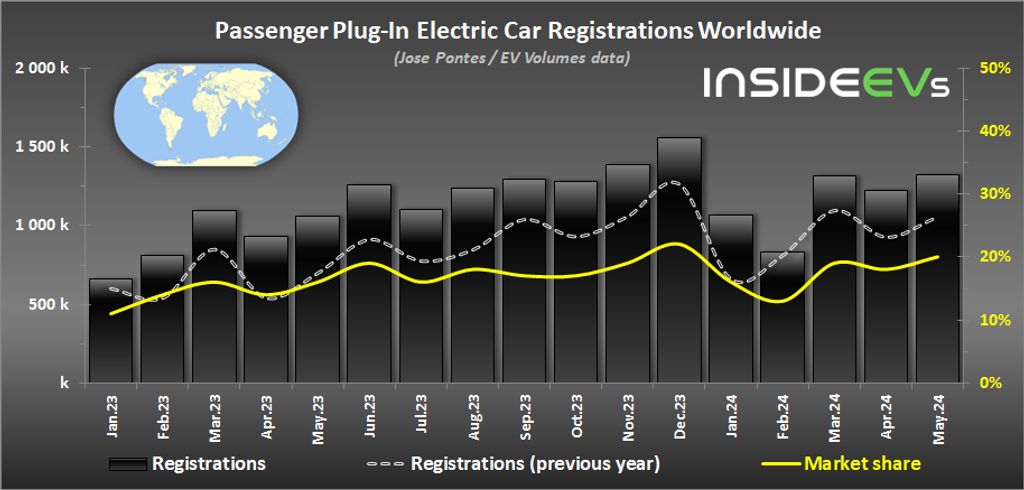

In May 2024, global registrations of plug-in electric cars continued to expand at a healthy rate despite a slowdown in some markets, particularly in Europe.

According to EV-Volumes data from researcher Jose Pontes, more than 1.32 million new passenger plug-in electric cars were registered globally in May. The market share amounted to roughly 20%, compared to 16% a year ago.

Global EV Sales Increases

During the first five months of the year, plug-in car sales exceeded 5.5 million units. The full year 2024 is expected to end between 15 to 20 million units (probably close to 20 million, depending on the usual acceleration in the second half of the year).

All-electric car registrations accounted for about 66% of all plug-in car registrations, which is more than 860,000 units. The growth rate wasn’t bad at all, reaching 17% year over year.

However, plug-in hybrid car registrations expanded much faster, by 37% year-over-year, reaching roughly 450,000 in May.

The report indicates that the Chinese market represents over 60% of the total plug-in electric car sales globally and grew quickly at 33% year-over-year in May. On the other hand, the rest of the world is also growing, despite Europe being down 10%. Specifically, the U.S. and Canada were up by 18% year-over-year.

Smaller markets outside of the big three (China, Europe, and the U.S./Canada) posted big gains. Mexico, Chile, and Malaysia more than doubled their plug-in car sales, while Brazil more than tripled, and Russia noted a massive 549% year-over-year increase (from a low base), mostly thanks to Chinese manufacturers’ colonization of the car market.

In other words, electrification is taking off almost everywhere, although the process is not smooth, and there will be periods of local decline.

Plug-in car registrations for the month (YOY change):

- BEVs: about *874,000 (up 17%) and 13% market share

- PHEVs: about *450,000 (up 37%) and 7% market share

- Total: 1,324,141 (up 23%) and 20% market share

* estimated

More than 5.6 million plug-in electric cars were registered worldwide in the first five months of the year. That’s about 17% of the total volume.

Plug-in car registrations January-May (YOY change):

- BEVs: about *3.6 million and 11% market share

- PHEVs: about *2.0 million and 6% market share

- Total: 5,683,483 (up 25%) and 17% market share

* estimated

For reference, in 2023, almost 13.7 million plug-in electric cars were registered worldwide, which was 16% of the total volume. That’s up from 14% in 2022, 9% in 2021, and 4% in 2020. 2024 should be even better, at 15-20 million.

Model rank

In May, just like the previous months, the Tesla Model Y remained the world’s best-selling plug-in model, with 89,120 new registrations, down 6% year-over-year.

Behind the Model Y were the two BYD model families: Song (63,371) and Qin (49,294). In total, there are six BYD nameplates in the top eight and eight Chinese EVs in the top ten.

Top 10 for the month:

- Tesla Model Y – 89,120

- BYD Song – 63,371 (15,409 BEVs + 47,962 PHEVs)

- BYD Qin Plus – 49,294 (17,113 BEVs + 32,181 PHEVs)

- Tesla Model 3 – 45,051

- BYD Seagull (aka Dolphin Mini) – 36,323

- BYD Yuan Plus (aka Atto 3) – 32,806

- BYD Destroyer 05 (PHEV) – 25,140

- BYD Han – 18,048 (10,145 BEVs + 7,903 PHEVs)

- Aion Y – 17,506

- Aito M9: 16,462 (1,738 BEVs + 14,724 PHEVs)

* BEV and PHEV versions of the same models were counted together in the source.

Despite the Tesla Model Y’s leadership, the top 10 has become dominated by Chinese EVs, and even the two Tesla cars are produced in high volume in China.

Brand rank

In terms of brands, BYD continued to sell the highest number of plug-in electric cars. Its most recent result of 314,760 in May was substantially higher than Tesla’s 140,683. However, Tesla offers only all-electric cars. In the EV category, the numbers are relatively similar, with a slight advantage of Tesla over BYD so far this year.

Top 10 for the month:

- BYD – 314,760

- Tesla – 140,683

- BMW – 45,615

- SAIC-GM-Wuling – 39,849

- Volkswagen – 38,210

- Li Auto – 37,017

- Aito – 32,507

- Volvo – 32,166

- Aion – 30,759

- Geely – 29,663

After the first five months of the year, BYD is the only brand with more than one million units sold. Tesla remains the best of the rest in the all-electric car segment. Other top brands usually sit between 140,000 and 220,000 units. A big surprise for many is the powerful position of BMW, which is third.

Top Automotive Groups

BYD Group accounts for 22.1% of all plug-in car sales globally, while Tesla and Geely-Volvo account for 11.0% and 7.9%, respectively.

Top automotive groups by share in the plug-in segment in January-May:

- BYD Group – 22.1% (1,258,835)

- Tesla – 11.0% (625,596)

- Geely–Volvo – 7.9% (451,242)

- Volkswagen Group – 6.3% share (359,163)

- SAIC – 5.4% (308,890)

including the SAIC-GM-Wuling joint venture (between SAIC, GM and Liuzhou Wuling Motors) - BMW Group – 3.9%

- Changan – 3.9%

- Stellantis – 3.9%

- Hyundai Motor Group – 3.5%

If we exclude plug-in hybrids, the comparison of automotive groups is significantly different. Tesla sold more all-electric cars than BYD during the first five months of the year.

Other manufacturers are noticeably behind but are progressing. The Volkswagen Group remains fifth, behind Geely–Volvo and SAIC.

Top automotive groups by share in the all-electric segment in January-May:

- Tesla – 17.2% (625,596)

- BYD Group – 16.0% (580,974)

- Geely–Volvo – 7.5% (271,472)

- SAIC – 7.0% (255,287)

including the SAIC-GM-Wuling joint venture (between SAIC, GM, and Liuzhou Wuling Motors) - Volkswagen Group – 6.9% share (250,539)

- BMW Group – 4.3%

Read the full article here