Even if all goes well, Toyota’s solid-state battery technology won’t make up a significant portion of the EV market—or Toyota’s own output—by the end of the decade.

That’s a reality check contained in a recent document that perhaps serves to temper some of the recent hype over solid-state battery tech. Solid-state batteries promise faster charging and lighter weight, two game-changing aspects that might make EVs click for the mass market in the future. Toyota’s plans for the tech in particular have made headlines because they could help the brand gain an advantage on Tesla and other automakers.

Toyota solid-state battery prototype

A recent piece in the automaker’s Toyota Times newsletter provided a detail that hadn’t been included in other recent releases: “In the mass production phase anticipated for 2030 and beyond, the companies are looking to boost capacity to several thousand tonnes (several tens of thousands of vehicles) in line with Toyota’s product plans.”

That underscores the likelihood that even well into the 2030s, Toyota solid-state batteries are likely to remain a low-volume endeavor, limited to niche vehicles such as a low-volume sports car.

Toyota FT-Se concept

Toyota sold 10.48 million vehicles globally in 2022. So if Toyota can perhaps make 30,000 solid-state EVs (an example based on the common use and meaning of the word several), that would be less than a third of a percent of the automaker’s annual sales, or a very small fraction of what its EV sales are likely to be by then.

To frame it another way, Toyota announced earlier this year that it aims to sell more than 100,000 hydrogen vehicles annually by 2030. It has higher hopes for fuel-cell volume than solid-state battery volume by the start of the 2030s.

The solid-state timeline was recently refreshed as Toyota in October revealed a partnership with the Japanese oil company Idemitsu Kosan. The partnership aims to push solid-state battery tech toward production through development of sulfide solid electrolytes at a “large pilot facility” constructed and operated by Idemitsu.

Toyota earlier this year remodeled its targets to include a “base volume” sales target of 1.5 million EVs annually (globally) by 2026, which happens to be about how many hybrids it sold annually in 2016. Despite plans for a U.S.-made three-row EV starting in 2025, it hasn’t provided U.S. EV projections since 2021, when it expected that battery electric vehicles and fuel-cell models combined would make up 15% of its U.S. sales in 2030.

Toyota Land Cruiser Se concept

In September, in a company press release, Toyota said that it expected solid-state batteries by 2027 or 2028 to be “ready for commercial use”—made possible by “technological advancements” that would extend battery life, a point of uncertainty for the tech.

From its earliest generation of lithium-ion solid-state battery tech it sees arriving from 2027 or 2028, Toyota is aiming for a WLTP driving range of more than 621 miles (potentially landing around 450 miles or more on the EPA cycle for U.S.-market EVs), plus a fast-charge time from 10-80% of just 10 minutes.

2023 Toyota Prius

It’s unclear whether the company still plans to roll out some of its solid-state batteries in hybrids, which had been the plan as recently as January 2022. Such tech might help make a revamped version of the Prius, once a hybrid trendsetter, relevant or even a green leader again.

Solid-state technology promises to nearly double energy density (on a weight basis) while permitting faster charging and likely increasing the safety and stability of cells. But there are manufacturing and longevity issues yet to be solved on the way to mass production.

Toyota arguably has the R&D advantage. It’s been a longtime research partner in the field with Panasonic, going back to the 1990s, and together they have the worldwide lead in patents relating to the tech. Idemitsu is just behind them, in third place, so Toyota is effectively tapping into a vast knowledge base.

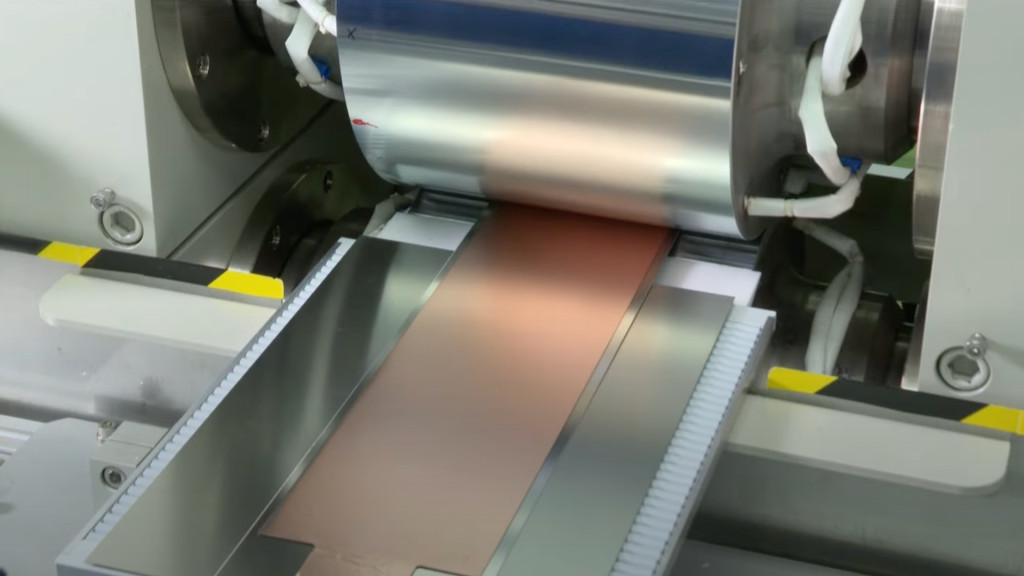

Honda solid-state battery prototype manufacturing

Toyota isn’t the only one banking some of the future on solid-state tech. In addition to the cell makers themselves, Nissan and Honda are both independently working to develop their own all-solid-state cells to be produced at pilot production facilities next year. Nissan wants to scale them up for mass-production, with a production EV, by 2028, although it hasn’t yet explained what volume it intends by then. Nissan sees them as a potential game-changer for large electric pickups and SUVs, partly as they might not need cooling at all.

Read the full article here