The U.S. Treasury Department on Friday announced an update on how vehicles will qualify as a car or an SUV under the revamped EV tax credit, now known as the clean vehicle tax credit.

For EV shoppers it’s good news, as it will clear up a confusing and seemingly arbitrary dividing line in which some versions of certain models—like the Tesla Model Y—were made eligible at a higher MSRP while others weren’t.

The new credit set under the Inflation Recovery Act incorporates a number of changes, including income caps, as well as domestic sourcing rules not yet enforced. But it also sets price caps for qualifying EVs, of $55,000 for new cars and $80,000 for pickup trucks, SUVs, and vans; and so far that’s been one of the most fraught for shoppers.

2023 Volkswagen ID.4

Simply put, some models classified as SUVs on their window stickers were being limited to the $55,000 cap.

What changes: Look at the window sticker

To make it easier for consumers to know which vehicles qualify under the applicable MSRP cap, Treasury is updating the vehicle classification standard to use the consumer-facing EPA Fuel Economy Labeling standard, rather than the CAFE (corporate average fuel economy) standard.

“This change will allow crossover vehicles that share similar features to be treated consistently,” stated the Treasury Department,” in a release. “It will also align vehicle classifications under the clean vehicle credit with the classification displayed on the vehicle label and on the consumer-facing website FuelEconomy.gov.”

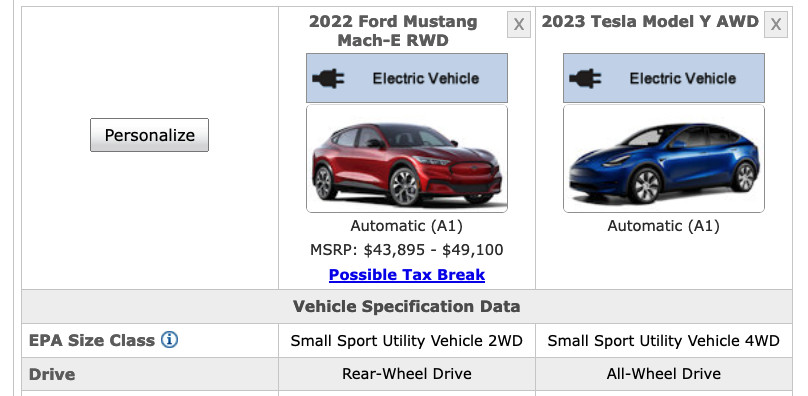

Ford Mustang Mach-E and Tesla Model Y example for EPA class

Shoppers can find the EPA classification of a vehicle at FuelEconomy.gov, and clicking the “Specs” tab. For instance, the Tesla Model Y and Ford Mustang Mach-E lineups are both classified as “Small Sport Utility Vehicle” by the EPA—making clear that they would now be eligible.

And to underscore this, the IRS had already, on Friday morning, updated its list of qualifying vehicles and their respective price caps.

How this happened

For the sake of clarity, it’s a good move. So how did this happen in the first place?

The Treasury Department decided to use the definition between car and SUV with historical precedence. Under that, SUVs with a gross vehicle weight under 6,000 pounds are lumped with trucks only if they have four-wheel drive (or all-wheel drive).

It dates back to the 1970s—well before SUVs were any significant market classification of passenger vehicles—and it hasn’t been updated significantly since then.

This regulatory distinction between cars and SUVs is only currently used to calculate corporate average fleet fuel economy (CAFE)—a compliance obligation, and a gauge by regulators on how well the industry is doing in keeping up on efficiency and emissions standards. But the list of vehicles that factor into CAFE as cars or trucks and why isn’t laid out anywhere clearly anywhere in a form consumers can understand.

2022 Ford Mustang Mach-E

Further, the application of the CAFE distinction between cars and SUVs doesn’t provide much of a useful distinction between vehicle types and how they might actually be shopped or used.

So the use of it for the EV tax credit essentially threw down a dividing line down in the middle of the SUV field, penalizing lighter models with two-wheel drive, while rewarding heavier models with all-wheel drive, more seats, and perhaps performance options.

Yes, it’s retroactive—to January 1

The Treasury Department says that those who placed a vehicle in service (took delivery) since January 1, 2023, that qualifies under the new definition and satisfy all the other credit requirements will be able to claim it—even if the vehicles didn’t qualify up until today.

Now that we have clarity on vehicle types qualifying for certain price caps, the Treasury notes that another update is coming. Guidance on U.S. sourcing for critical minerals—an area of the tax credit not yet being enforced—is due to be issued in March, and it’s likely to narrow the field significantly for EVs that qualify for the full credit.

Read the full article here