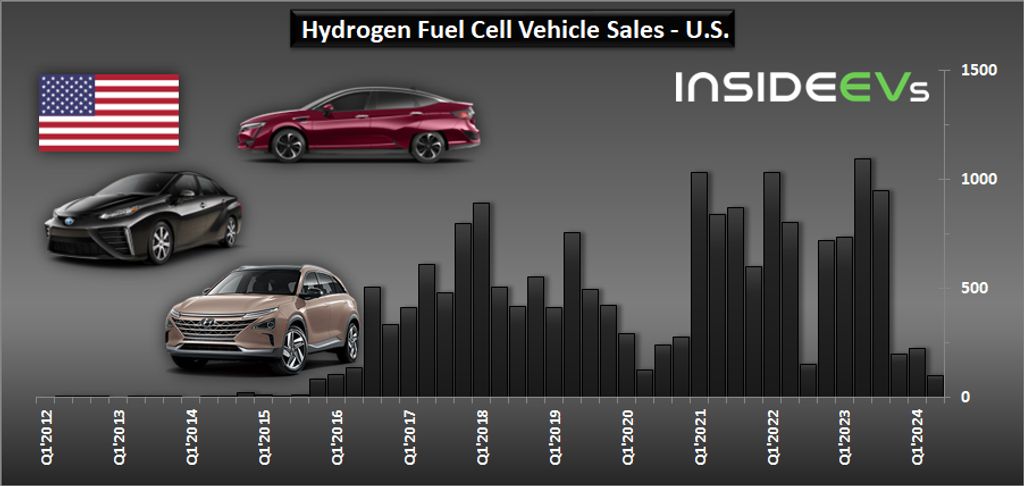

The second quarter of 2024 brought a significant decrease in hydrogen fuel cell car sales in the United States. By that, we mean in California, where the series-produced models are available.

According to the Hydrogen Fuel Cell Partnership’s data, only 99 new hydrogen fuel cell cars (FCV or FCEV) were sold in the U.S. in Q2. It’s a 91% year-over-year decline and the lowest level since Q4 2015 when the hydrogen niche was in its infancy.

Hydrogen fuel cell cars struggle to sell

Hydrogen fuel cell cars struggle to attract customers. There are only a few models available in California, and the refueling infrastructure is limited. On top of that comes not necessarily competitive vehicle and refueling costs.

The Hydrogen Fuel Cell Partnership’s FCVs sales data comes from Baum and Associates and is based on sales to retail and fleet customers.

When it comes to FCV models, there are only two right now and they are both declining. The Toyota Mirai is the primary one with 73 sales in Q2, down 93% year-over-year. The Hyundai Nexo sales amounted to 26 units in Q2, down 35% year-over-year.

In the second half of the year, Honda will re-join the hydrogen niche with its 2025 Honda CR-V e FCEV model with plug-in capability. However, it will be available for lease only and on a limited scale of “north of 300 units” per year. It means that the introduction of the hydrogen-fueled CR-V will not change the overall FCV picture.

Hydrogen car sales in Q2 2024 (YOY change):

Hydrogen sales reported by the manufacturers in Q2’2024 (YOY change):

- Toyota Mirai: 73 (down 93%)

- Hyundai Nexo: 26 (down 35%)

In the first half of the year, FCV sales amounted to 322 units and were 82% lower than a year ago.

Hydrogen car sales in Q1-Q2’2024 (YOY change):

Hydrogen sales reported by the manufacturers in Q1-Q2’2024 (YOY change):

- Toyota Mirai: 245 (down 86%)

- Hyundai Nexo: 77 (down 27%)

For reference, in 2023, 2,978 new hydrogen cars were sold (the numbers were updated compared to the previous report), some 10% more than in 2022.

It’s hard to be optimistic about the hydrogen fuel cell cars. The availability of vehicles and refueling infrastructure remains limited. On top of that, high prices of hydrogen make driving expensive. There are also slim to no advantages regarding the range or refueling time versus the fast charging of modern EVs. Hydrogen cars also are inefficient compared to battery-electric vehicles.

The FCV niche seems to be disappearing. It appears to us that the window of opportunity for FCVs closed when EVs were strengthened by long-range versions and promising fast charging solutions of up to 80% state-of-charge in less than 20 minutes.

Tesla CEO Elon Musk recently noted, by way of a separate hydrogen-related discussion on X, that “Hydrogen is silly for cars and only barely sensible for rockets, where the payload is ~1000 times more valuable.”

The overall cumulative sales of FCVs in the U.S. exceeded 18,000 as of the end of the quarter. This number includes over 14,000 Toyota Mirai, which accounts for almost 79% of all FCVs sold.

As of July 3, 2024, the number of open retail hydrogen stations in California stood at 54 (one less than in April):

- Open – Retail: 54 (down 1)

- Open – Legacy Retail: 0

- Currently Unavailable: 7 (up 1)

- In Construction: 2

- In Permitting: 18

- Proposed: 4

- Total (Light Duty): 85 (down from 90 in April and 97 in January)

See the full list of hydrogen infrastructure here.

A quick calculation reveals there are 338 cars per station based on cumulative sales divided by the number of open retail stations. Although it’s actually less due to the early cars that have been removed from service.

Read the full article here