As we cover a year that’s been marked by up-and-down electric vehicle sales—with some brands doing well, others slowing down and few consistent trend lines overall—there’s one thing that seldom gets factored into the discussion: Just how much do America’s car dealers even want to sell EVs?

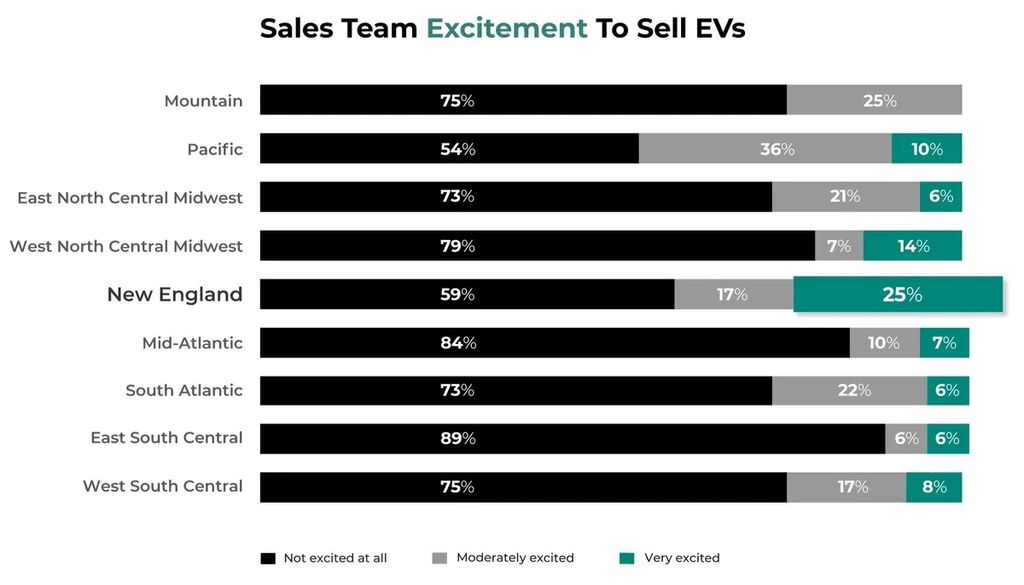

According to a new survey of 250 “dealership leaders” across the U.S., the answer varies wildly by region. But that answer is generally “not at all,” or varying degrees of moderate excitement at best.

“A surprisingly large number of U.S. auto dealers say their sales staff aren’t enthusiastic about selling EVs,” the survey from auto retail software and data firm CDK Global indicates.

Dealers tend to be bad at selling EVs—or just not interested

Can America’s EV revolution happen if car dealers aren’t enthused about them? That’s an open question. But it’s a big problem for traditional brands like Ford, Chevrolet and Hyundai, who are legally required to go through third-party franchised dealers to move cars.

The study further illustrates a trend that’s pretty widely known anecdotally but is seldom considered in conversations about EV growth: that by and large, America’s car salespeople aren’t really amped about the electric revolution.

But this study shows that those attitudes reflect their customer bases, and have a direct impact on how much their sales staff are trained to go electric. (And yes, this is the same CDK Global that had that disastrous software hack recently; still, we have no reason to doubt the veracity of this study.)

Graphic: CDK

“A startling 49% [of respondents] said their sales teams weren’t excited at all about selling EVs,” the study said. “It should come as no surprise that the Pacific region (which includes EV-loving California) scored high on excitement. Yet, even there few were ‘very excited.'”

This has been a long-running trend in the auto industry. It’s one reason that early on, Tesla decided to go with its direct-sales model rather than through franchised dealers; its fear was that it couldn’t count on third-party stores to educate customers, or that they would “revert to selling what’s easy” and known over something entirely new.

To their credit, Elon Musk and co. weren’t wrong about that. Besides learning about how these new kinds of cars work, dealers have been historically resistant to installing charging ports at their stores, and tend to prioritize cars that will generate recurring parts and revenue income—which EVs generally don’t. Some dealers are known for actively pushing customers away from EVs; others have slightly more underhanded tactics. (One InsideEVs editor recently encountered a Ford dealership next to an F-150 Lightning with a large sign that warned customers of range losses in the cold.)

At the same time, the dealers cited in this study do have some reasons to be trepidatious. And those have to do with where they sell cars. The least EV-enthusiastic dealers are in the mountain states, where the charging infrastructure—public or otherwise—is far more sparse than in coastal states and major urban areas. If those customers can’t charge easily and they’re fearful of winter range losses, it’s no wonder dealers wouldn’t want to order a ton of cars they’d struggle to sell.

From the study:

One dealer in Montana put it bluntly, “We live in a rural area with large distances between towns … It’s just not a viable alternative to ICE.”

Another dealer in North Dakota pointed to the arctic climate as the kiss of death for EVs. “It’s primarily a range issue, which is always compromised when the heater is on full blast. If someone had to pull off the interstate due to inclement weather, they’d freeze to death at a rest stop.”

In all the years I’ve been doing this (and the 10 years before that I spent covering crime and public safety, where I wrote about a lot of accidental death) I can candidly say I’ve never heard of anyone literally freezing to death because their EV ran out of juice.

In fact, our own reporting indicates that getting stranded at 0% charge is far more of a fear than a reality, and while it’s possible, it happens quite rarely—and less so as the plug networks grow.

Graphic: CDK

But as this CDK study notes, the enthusiasm gap also has a lot to do with people not understanding the key benefits of EVs, like no more gas bills or the ability to be fully “fueled” in your home garage if it’s so equipped. That’s where sales staff training comes in, and there seems to be some correlation between proper training and interest in these cars:

Sales staff training was significantly high in New England, for example, with more than eight out of 10 (83%) very or extremely trained. And New England ranked first (25%) when it came to being very excited about selling EVs. The East South Central region, which was last in excitement over selling, reported only 24% of salespeople were very or extremely trained.

I also think this illustrates a weakness of the traditional auto industry: it’s used to just making and marketing cars, and then expecting everything else to spring up around it. That was true for a century, of gas stations, highways, regulations, insurance companies, repair shops and, yes, car dealers. An EV shift requires different ways of thinking about almost all of the above; it’s also why EV charger growth hasn’t happened quite quickly enough. Automakers are taking matters into their own hands more and more on that front, including building out their own charging networks just like Tesla once did.

Those same car companies are locked into state laws and franchise agreements with their dealers; they can’t pivot to direct sales like Tesla. (Not without getting sued into oblivion, anyway.) Some are experimenting with more novel approaches, like Hyundai’s plan to spec and price EVs on Amazon before taking final delivery and arranging payments at a local dealer. But even that is taking its time to hit critical mass.

In the end, all data signs point to the decline of purely internal combustion engines, both in the U.S. and worldwide. If dealers aren’t great at EV education, what’s to say they won’t struggle with the same on plug-in hybrids, for example? In the end, dealers everywhere could stand to take CDK’s advice:

“With the market continuing to grow, and a predicted second wave of EV-curious shoppers poised to be in play by the second half of the decade, it’s smart for dealers to ramp up EV training and get salespeople back to the basics of customer needs’ assessments.”

Meanwhile, I have a bunch of free oil change coupons from when I bought my Kia EV6 at a dealership. Let me know if you need any; for some reason, I don’t think I will.

Contact the author: [email protected]

Read the full article here